The foodservice industry continues to move on from its COVID-19 ways, but a variety of macroeconomic influences continue to slow that progress.

Total foodservice industry sales will hit $855 billion in 2023, per Datassential, a Chicago-based market research firm. That represents a decline of 0.1% in real growth compared to 2022. “The forecast can look relatively rosy in terms of year-over-year dollar growth, but that’s mostly attributed to inflation,” says Ann Golladay, associate director with Datassential.

Looking ahead, Datassential’s outlook for 2024 foodservice industry sales is essentially flat. In other words, expect more of the same for the next year or more.

Heading into 2022, most observers felt the foodservice industry was poised for a period of transition, as it started to move away from pandemic-driven restrictions to what would become a more normal mode of operation. And that transition continues as the calendar prepares to roll over to 2023. “The pandemic fundamentally altered how the restaurant industry operates overall. Many of the trends in place before COVID were amplified and accelerated by the pandemic,” says Hudson Riehle, senior vice president for the National Restaurant Association’s Knowledge and Research Group.

Heading into 2022, most observers felt the foodservice industry was poised for a period of transition, as it started to move away from pandemic-driven restrictions to what would become a more normal mode of operation. And that transition continues as the calendar prepares to roll over to 2023. “The pandemic fundamentally altered how the restaurant industry operates overall. Many of the trends in place before COVID were amplified and accelerated by the pandemic,” says Hudson Riehle, senior vice president for the National Restaurant Association’s Knowledge and Research Group.

Three macroeconomic challenges had a profound impact on overall restaurant industry performance in 2022: labor, supply chain and inflation. In fact, operators were pretty split when trying to decide which of those factors represented the biggest challenge: 37% said inflation, 33% said labor shortages and 30% said supply chain issues, per Datassential.

“When we were looking at 2022, it was going to be the year of the supply side choking the demand side,” Golladay says. “There was a lot of interest in getting back out there and enjoying some of these experiences. It was those first two — labor and supply chain — that limited people’s ability to go out. Inflation came out of nowhere and hit the industry hard.”

And there is no real reason to believe those three factors will have any less impact on the industry in 2023, either.

As a result of these macroeconomic pressures, operators’ margins continue to erode. In fact, the average operator profit margin was 21% prior to the pandemic and it declined to 13% in 2022, per Datassential. The severity of the margin erosion can vary considerably by operator segment. For example, QSRs saw a seven-point margin decline, which is in line with the industry norm. In contrast, corporate feeders experienced an 18-point decline, lodging a 13-point dip and college foodservice saw margins drop by 10 points.

In response to these mounting margin pressures, 77% of operators raised menu prices within the past 12 months, per Datassential. Among those increasing menu prices, 31% did so in the 1% to 5% range. And 29% raised prices in the 6% to 10% range. But did they raise prices enough to deal with the myriad of factors impacting their businesses? In some preliminary data, Datassential pegs menu price inflation at 5.6%. “They are getting squeezed,” Golladay says. “First it was COVID and now we have all of these other factors weighing on the industry.”

Despite all of the economic uncertainty, there remains a significant pent-up demand for restaurants among consumers. Specifically, 46% of adults say they are not using restaurants to dine on-premises as much as they would like, per a September survey fielded by the National Restaurant Association. In addition, 34% of adults say they are not ordering for takeout or delivery as much as they would like.

While consumers’ desire to use restaurants and foodservice remains strong, the traffic data shows an industry still in transition. For example, 47% of operators report an increase in consumer traffic compared to 39% that report the opposite, per Datassential. Once again, though, looking at traffic on a segment-by-segment basis paints a more complex picture. For example, 57% of operators in the lodging segment report an increase in traffic, but that segment was decimated by pandemic-related travel restrictions. So, in reality, those numbers had nowhere to go but up. “Some of that real variation can almost be counterintuitive,” Golladay says, “because some segments are not at pre-COVID levels yet.”

Probably a better indicator of the consumer traffic is QSRs, which held relatively strong throughout the pandemic. And for this segment, 50% of operators report increased customer traffic compared to 38% which report a decline. The data for noncommercial segments, such as healthcare and corporate feeders, paints a different picture. Only 24% of business and industry operators report increased traffic and only 32% of healthcare operators report an uptick in customers.

Further, according to the NRA’s tracking studies, “traffic for on-premises meal periods remains down from where they were pre-pandemic. Off-premises traffic across all three meal periods remains up,” Riehle says. “Looking at the industry overall, not only have traditional traffic patterns not returned, the underlying economy is also softening.”

And those two factors, the economy and consumer spending habits, go hand in hand.

The Economy

As always, consumer sentiment will play a big role in shaping foodservice industry performance in the coming year. And much like the economy, the consumers’ outlook is a little complicated.

The Conference Board’s Consumer Confidence Index increased in September for the second consecutive month, which in and of itself is positive. But a more detailed look at the numbers indicates some strong headwinds on the horizon. The reading of 108.0 represented a 4.4-point improvement from August. The study’s Present Situation Index, which quantifies consumers’ assessment of current business and labor market conditions, increased to 149.6 in September from 145.3 in August. The Expectations Index, based on consumers’ short-term outlook for income, business, and labor market conditions, increased to 80.3 in September from 75.8 in August.

In other words, consumers’ present outlook differs from what they anticipate in the not-so-distance future. “The gap is substantial. They are more optimistic about their personal finances. Household balance sheets are in pretty good shape. Savings levels are good at the moment. Consumer credit and debt is obviously going up,” Riehle says. “What that indicates is that consumers look around and feel OK about their situation at the moment but anticipate things won’t be as good in six months.”

In other words, consumers’ present outlook differs from what they anticipate in the not-so-distance future. “The gap is substantial. They are more optimistic about their personal finances. Household balance sheets are in pretty good shape. Savings levels are good at the moment. Consumer credit and debt is obviously going up,” Riehle says. “What that indicates is that consumers look around and feel OK about their situation at the moment but anticipate things won’t be as good in six months.”

One factor fueling consumers’ brighter near-term outlook is falling gas prices. By mid-September, the national average price for a gallon of gasoline declined by $1.34 from its June high, per AAA. Still, in early October there were signs that gas prices might be getting ready to increase again. Gas prices play an important role in shaping consumer sentiment. They not only impact their wallets, but gas is one of a few items everyone buys whose prices are displayed on street corners everywhere.

Make no mistake, though, inflation and interest rate hikes represent the most significant factors that will shape consumers’ ability to spend at restaurants in 2023.

In fact, eating and drinking place sales started to soften over the summer. Sales at foodservice and drinking places hit a post-pandemic high of $87.5 billion in May but failed to reach that level in June, July, August and September, per data adjusted for inflation from the NRA, the U.S. Census Bureau and the U.S. Bureau of Economic Analysis. This data points to the fact that operators will need to remain innovative in terms of how they profitably sustain their businesses on an ongoing basis. “Consumers are still managing their total spend and they will need a nudge — advertising, promotions, social media — to keep specific restaurant brands top of mind,” Riehle says. “You can spend hours talking about how operators have used technology to not only improve productivity and efficiency but also to support marketing programs.”

The good news is that restaurants still hold a special place in the hearts and stomachs of most consumers for some specific reasons. “We have learned that people still love going out to eat and value the convenience of service,” Golladay says. “So, I don’t think the industry is too fragile. But there’s a range of operators out there and their perspectives will vary depending on their market conditions.”

Adds Riehle, “Consumers do deem using restaurants as being essential to their lifestyle. It will remain an area of essential consumer spend in 2023. It takes 6 to 9 months for consumers to start to feel the impact of those interest rate hikes. The big question becomes: How damaged does the consumer become due to some of those higher interest rates?”

And that’s the riddle most economists are trying to solve.

Gross domestic product decreased at an annual rate of 0.6% in the second quarter of 2022, per the U.S. Bureau of Economic Analysis. This came on the heels of the BEA reporting GDP took a 1.6% dip in the first quarter of 2022. By definition, two quarters of negative GDP is a recession. Yet for various reasons, many economists seem reluctant to label this period a recession.

One reason is that the consumers posted some positive economic results in a few critical areas. For example, personal income increased $71.6 billion (0.3%) in August, according to estimates from the BEA. Disposable personal income increased $67.6 billion (0.4%) for the month and personal consumption expenditures (PCE) increased $67.5 billion (0.4%).

Further, employment data remains fairly stable. In September, for example, businesses added 208,000 positions, per ADP’s employment report for the month. This beat the monthly estimates and was greater than the 185,000 jobs added in August. Also notable about the ADP jobs report was the fact that growth came from all over, meaning one segment alone was not responsible for the positive results.

Conflicting results that pit negative GDP against strong employment leads to a lack of consensus and brings to mind the old adage that if you put three economists in a room you are likely to get four opinions. “There’s a term among economists — growth recession,” Riehle says. “That means certain economic indicators move forward while others shrink.”

The one thing most economists can agree upon, though, is economic growth will cool off in 2023. However, it appears any declines won’t be as steep as previous recessions.

For example, in September, Fannie Mae’s Economic and Strategic Research Group projected 2022 GDP would have an overall growth rate of 0.0%. In other words, after two consecutive quarters of contraction, the economy will heat up a little and consumer spending will finish the year strong. This will lead to flat results on a year-over-year basis.

Fannie Mae also projected U.S. GDP would decline 0.5% in 2023. While far from ideal, this is nowhere near the declines from previous recessions. For example, the U.S. economy contracted 3.4% in 2020, 2.6% in 2009 and 1.8% in 1982. “The expectation is that if there is a recession it would be relatively mild. If that holds true, then consumers would still allocate money for restaurant meal solutions,” Riehle says.

The good news is that overcoming a challenging operating environment is nothing new to the foodservice industry. “The industry has always been innovative and flexible and quick to respond to customers’ wants and needs,” Riehle says. And that resilience will come in handy in 2023. Just as 2022 was to be a year of transition, 2023 will be a year where that transition is maintained.”

Golladay agrees. “It’s a steady state. I don’t think we are going to see major contractions,” she says. “But I don’t think we are going to see major expansion either.” She feels the opening of new restaurants and the closing of existing ones “will be a bit of a wash. Some folks are feeling the pinch with their margins and that could contribute to some places deciding to close. For some operators it’s become more of a focus of getting through the struggles each day.”

Operator Impacts

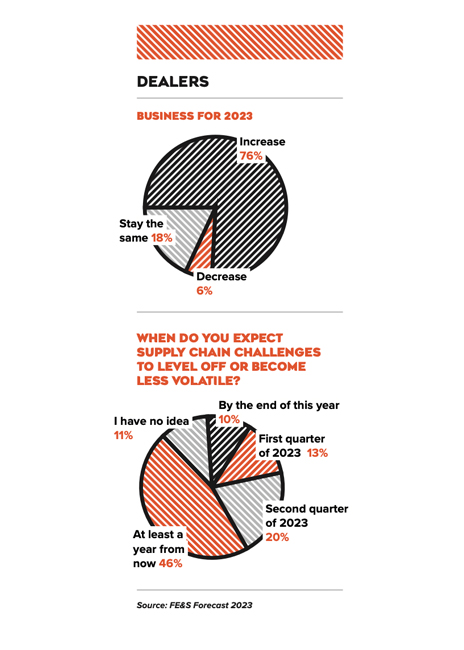

Following the theme of more of the same, labor and supply chain challenges will remain significant pain points for the industry in 2023. “The proportion of operators reporting recruiting and retention of labor as a key factor has risen,” Riehle says. “Although the impact of supply chain has declined somewhat, it’s still the second largest challenge.”

Labor remains a multifaceted challenge for operators to address but a few common themes have emerged. Specifically, 67% of operators say prep cook/line cook/short order cook represents the most difficult position to fill, per Datassential. Second on that list is dishwashers at 51%. Further, 32% of operators say the culinary skill of the employees they hire is lower than it was last year. This is especially true in such segments as college and university foodservice, QSR, corporate feeding and healthcare.

While supply chain, labor and inflation continue to dominate the conversation, rising food costs have emerged as the top concern for operators (63%), per Datassential. Of course, supply chain, inflation and rising food prices are all intertwined. Still, it’s worth noting this issue scored 24 points higher than inflation and 25 points higher than staffing issues.

Taken individually, each of these challenges could significantly impact the industry in any given year. What’s notable is the intensity surrounding all of them remains fairly consistent. “There’s still so many challenges and that’s why it’s a shuffleboard approach to addressing them as operators strive to keep their businesses viable,” Riehle says. “That’s why you’ve seen so many changes to business models.”

Along those lines, expect operators to continue to diversify their revenue streams in order to minimize their risk. Per Datassential, 27% of operators have shifted more toward serving off-premises customers. Prior to the pandemic, many white tablecloth restaurants would never consider takeout or delivery service for a variety of reasons. Now the fine-dining concept that won’t offer these services represents the exception rather than the norm. That’s because as of September, of the 560,000 jobs the restaurant industry was down from its pre-pandemic levels, most of them came from operators in the table service segment, per Riehle.

Further, many casual dining and even quick service concepts now run virtual restaurants from their kitchens as a way of maximizing revenue from a given location.

“It’s a little like a mutual fund approach in that it mitigates the risk of being unduly concentrated to a specific segment,” Riehle says. “That ratcheted up use of off-premises is here to stay. It’s a permanent enhancement of the industry that has allowed operators to pivot and tap into consumers’ appetites for off-premises dining.”

The combination of needing to diversify their businesses and find ways to combat labor shortages will lead operators to lean deeper into technology and other forms of innovation. “The technology impact will only continue to be more substantial. The consumer sees some of that investment, but our research indicates significant funds are being invested in the management of that technology and equipment,” Riehle says. “It’s important to look at technology as an enhancement to and not a replacement for labor. The ability to use technology becomes more paramount. It’s more of an investment than an expense.”

Signs of Progress

Given the operating environment will remain complex and the economic messaging mixed, what are some signs the industry is headed in the right direction? “Overall, you want to see industry traffic continue to advance. And restaurant employment is a good proxy for how restaurants are doing,” Riehle says.

It’s also a good idea to keep in mind that all economics are local. “Know what’s going on in your microeconomic market. There are substantial variations on a regional, as well as a state and city basis,” Riehle says.

Another key indicator of industry performance will come in the form of menu development, per Golladay. “Are operators expanding their menus instead of contracting? Seeing operators add to the menus would be positive. And the types of things they are adding and buying will be telling. Are they purchasing premium or value items?”

Technology is proving a real positive for operators, too. “During COVID adding technology happened out of necessity, but the companies that did it are now reaping those benefits,” Golladay says.

And technology will play an important role in helping restaurants attract that next generation of customers. “It’s incredibly powerful. To some of us, we can’t understand the metaverse but to certain generations it’s part of how they socialize,” Golladay says. “The way some consumers relate to each other it will all be through technology.”

Prior to the pandemic, operators focused their efforts on generating as much foot traffic as possible. That focus has shifted somewhat for the moment, though, as operators continue to deal with staffing issues. “A lot of places don’t want more feet in the door. They are managing with the labor they have,” Golladay says. “A lot of it is focusing on existing customers and boosting those check averages.”

And technology can help in this area by providing greater and easier access to restaurant food. “Consumers have way more options and a lot of ways to access those options,” Golladay says.